The Future of CPA Licensure in California

More flexibility. Same prestige. Your path, your pace.

A new CPA licensure framework is here—and it’s designed with you in mind.

AB 1175, the most significant update to California CPA licensure in decades, creates more options for earning your CPA license.

This new framework opens doors, especially for those who want to enter the workforce sooner or who value hands-on experience. It’s about expanding access and creating more flexible, affordable pathways—while maintaining the strong consumer protections the profession is known for.

Sponsored by the California Board of Accountancy and supported by CalCPA, AB 1175 is the result of years of work to modernize licensure and ensure the profession is ready to meet the needs of Californians today and into the future.

We know you’ll have questions as California transitions to this new model. These resources are here to help you understand what’s changing and how to prepare for the path ahead.

Stay connected. As regulations and guidance are developed, we’ll keep you informed every step of the way.

What is AB 1175?

Assembly Bill 1175, authored by Assemblymember Jacqui Irwin, sponsored by the California Board of Accountancy and supported by CalCPA, was signed into law on Oct. 4, 2025. This landmark legislation modernizes CPA licensure in California by creating a licensure framework that is more accessible with more flexible, affordable and inclusive options. These updates align licensure with today’s market needs and consumer expectations, ensuring CPAs remain trusted advisers and providers of essential services. AB 1175 also strengthens California’s long-standing CPA cross-border practice program, ensuring CPAs can continue meeting consumer needs effectively across state lines.

A New Licensure Framework: You’ve Got Options

The three E’s of CPA licensure—education, exam and experience—are still the foundation of becoming a CPA. What’s changing under AB 1175, effective Jan. 1, 2027, is how you can meet those requirements.

This new framework is designed to give you more options so you can choose the path that best fits your career goals and professional journey. At its core, you’ll need to earn a bachelor’s degree with an accounting concentration, pass the Uniform CPA Exam and complete two years of general accounting experience. What’s gone is the old requirement for 150 semester units and 30 additional credits beyond most bachelor’s degrees.

Instead, you’ll have choices. You can substitute a qualifying master’s degree for one year of experience or complete an approved accounting certificate program to reduce the experience requirement by six months. These added pathways recognize that there’s more than one way to gain the knowledge and skills needed to be a CPA.

At the same time, this new framework keeps what matters most: the high standards and strong consumer protections that have always defined the CPA profession.

Becoming a CPA is a big step—no matter which path you choose, you’re building toward a respected and impactful and rewarding career.

Get Ready for Changes

Big updates are coming to California’s CPA licensure requirements—so now’s the time to plan ahead!

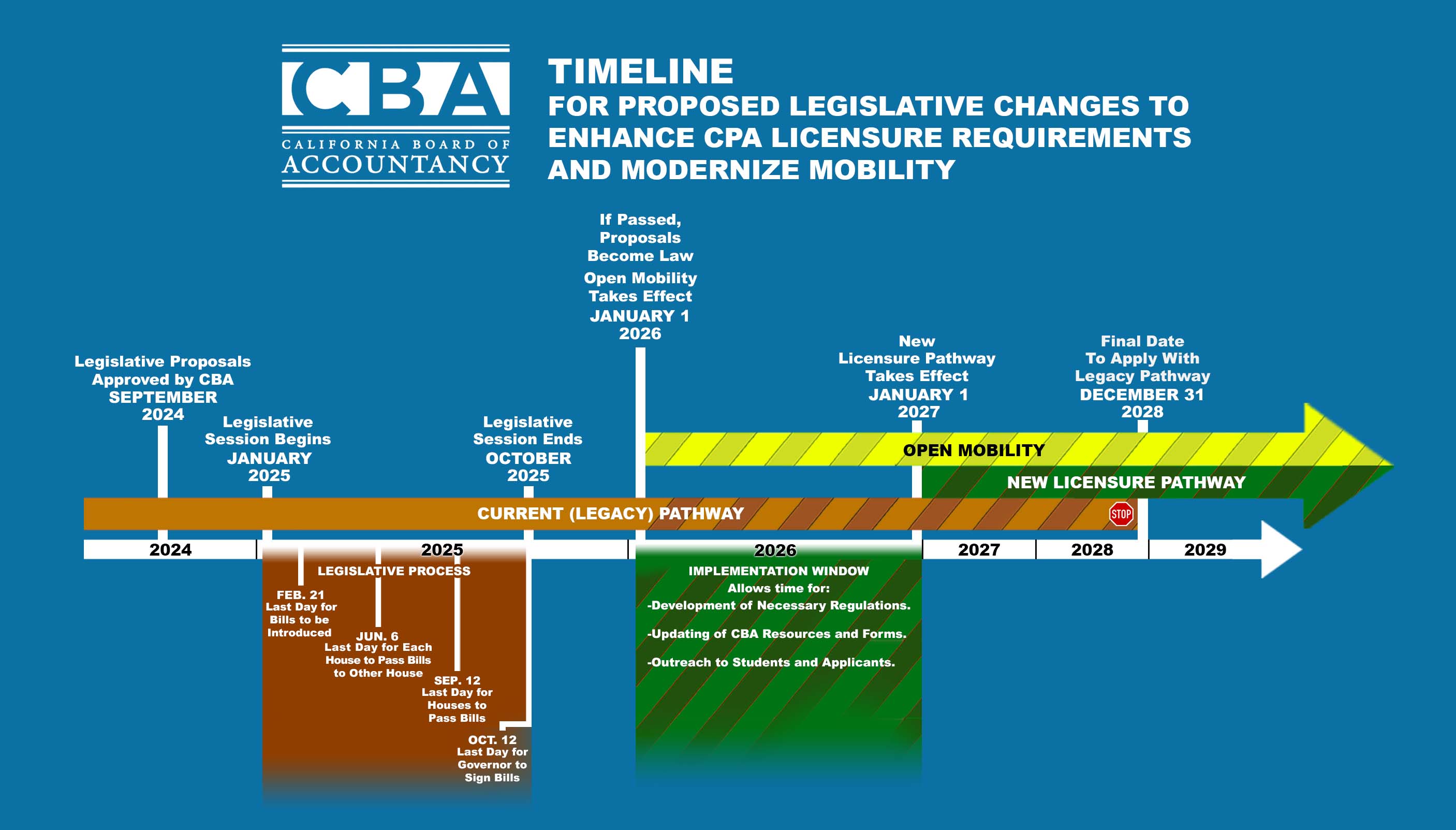

Jan. 1, 2026: The law takes effect with updates to CPA Mobility and the CBA develops regulations and guidance.

Jan. 1, 2027: The new licensure pathway launches.

Jan. 1, 2027–2028: Both the current "legacy" pathway and new AB 1175 pathway will be accepted.

Jan. 1, 2029: The new AB 1175 pathway becomes the only option.

Check out the full rollout timeline and start mapping your path to becoming a CPA.

More resources

Education = Bachelor’s Degree + Accounting Concentration

Learn moreExam = Core + Discipline

Learn moreExperience = Ultimate Flexibility

Learn more

Frequently asked questions

You have questions and we have answers. Click here to learn more.