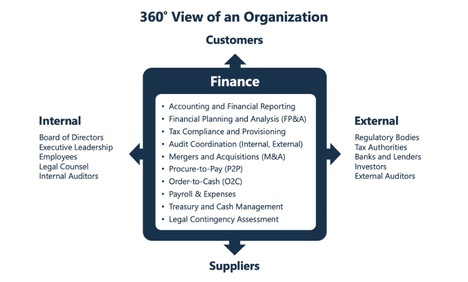

Finance sits at the heart of every organization. It touches nearly every department and external stakeholders, providing a 360-degree view of operations. Keeping up with this wide-ranging responsibility takes substantial effort. There's a constant flow of data to manage, regulatory deadlines to meet and major business decisions that need solid analytical backing.

Artificial Intelligence is now transforming how finance teams operate. While traditional software follows rigid rules, AI is different: It can reason, recognize patterns and integrate directly with ERP systems, spreadsheets and communication tools that teams already use. For finance professionals, AI marks a shift from processing transactions to overseeing intelligent systems. This change requires an investment in new technology and a willingness to evolve professionally.

Where AI Makes the Biggest Difference

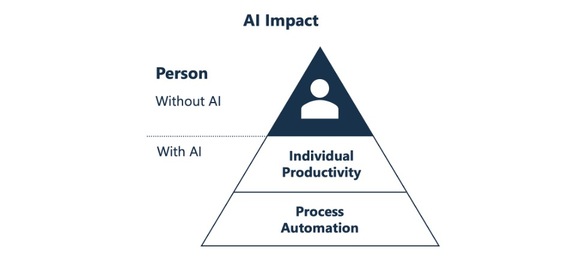

AI's impact on finance comes down to two main factors that reinforce each other: people becoming dramatically more productive with their individual tasks and entire business processes being automated.

Individual Productivity

AI enhances individual output by automating routine office work, drafting communications, creating presentations, synthesizing meeting notes and conducting research. Modern AI serves as both an analytical partner and a coaching tool. Junior staff can upskill faster, and senior professionals can delegate more effectively.

The productivity gains are substantial. Tasks that previously required hours, such as preparing variance analyses, drafting board materials or researching accounting guidance, can now be completed in minutes. The result? Finance professionals can spend less time crunching data and more time advising on strategy.

Process Automation

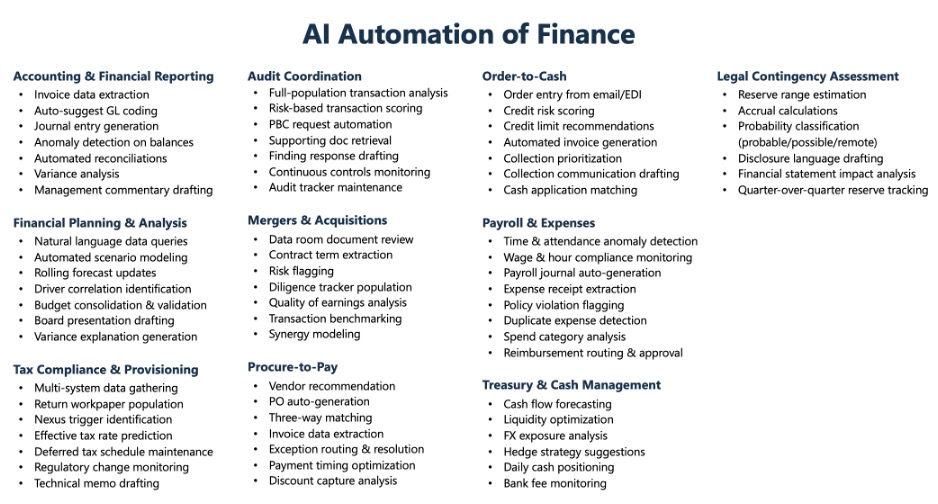

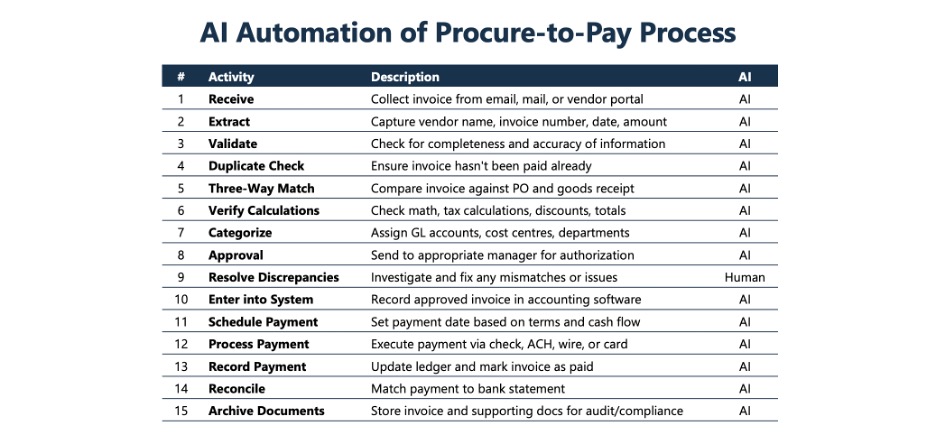

Beyond individual productivity, AI enables the automation of entire workflows across multiple roles within the finance function and across other departments. The following areas represent processes where AI can reliably automate thousands of tasks with minimal human intervention:

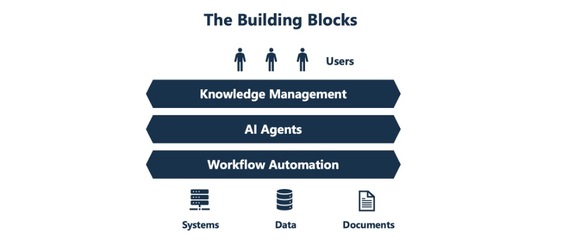

The Building Blocks

To realize AI's full potential, organizations must implement three foundational capabilities that work together as an integrated system.

Workflow Automation: iPaaS (Integration Platform as a Service) tools serve as the digital plumbing that connects software systems across an organization. These platforms move data reliably and predictably, syncing payment information from your ERP to a dashboard, kicking off approval workflows, or updating records across systems without manual intervention.

This automation layer forms the essential foundation. Without reliable data pipelines feeding into them, AI systems simply can't make intelligent decisions.

AI Agents: Built on top of workflow automation, AI agents serve as intelligent actors that retrieve information, execute tasks and handle end-to-end activities with minimal human intervention. These agents can act as a concierge (answering questions about financial data), an assistant (preparing specific deliverables) or an autonomous coworker (managing entire processes, such as invoice approval).

Multi-agent systems can surface increasingly sophisticated insights, catching early warning signs that would be nearly impossible to spot manually.

Knowledge Management: AI agents require clear instructions to operate effectively. Rather than doing repetitive work themselves, finance teams guide agents by providing SOPs, policy documents, regulatory requirements and decision rules to follow. Organizations that document their processes, spell out the rules, and track exceptions tend to implement AI faster and achieve better results than those trying to automate workflows that were never documented. Interestingly, AI can also help close documentation gaps quickly.

Solution Options

Organizations have three primary paths to AI implementation, each suited to different needs and capabilities:

Point Solutions: Specialized AI tools automate individual steps in a process. An intelligent document processing tool, for instance, can read an incoming invoice, extract the line items and prepare a data entry for the accounting system. These solutions offer quick implementation and immediate ROI but address only discrete tasks rather than end-to-end workflows.

Purpose-Built AI Products: Specialized AI automation platforms for finance, such as Hyperbots, offer co-pilot solutions that can handle multiple financial processes end-to-end and integrate with accounting and other systems. These products use multi-agent systems and sophisticated agent memory databases to automate entire processes, such as procure-to-pay, rather than just individual steps. Human involvement shifts from moving data between systems to resolving exceptions and validating outputs.

When evaluating these products, consider how well they integrate with your existing stack, which security certifications they hold and whether the vendor has a clear plan to keep up with AI advances.

No-Code Platforms: No-code enterprise AI platforms, such as Workato, enable business users to build custom automations without programming expertise.

One company has built a conversational agent that tracks contract approval status and follows up with relevant people via chat when there are delays, giving managers the opportunity to approve via chat. Another agent allows anyone to request a subscription and receive instant approval. The same agent then tracks the user's logins to the software application and, when the user is no longer using it, suggests canceling their subscription.

Some organizations now treat no-code proficiency as a core skill, on par with Excel spreadsheet competency, and train employees across departments to build their own productivity automations.

AI Strategy at Different Scales

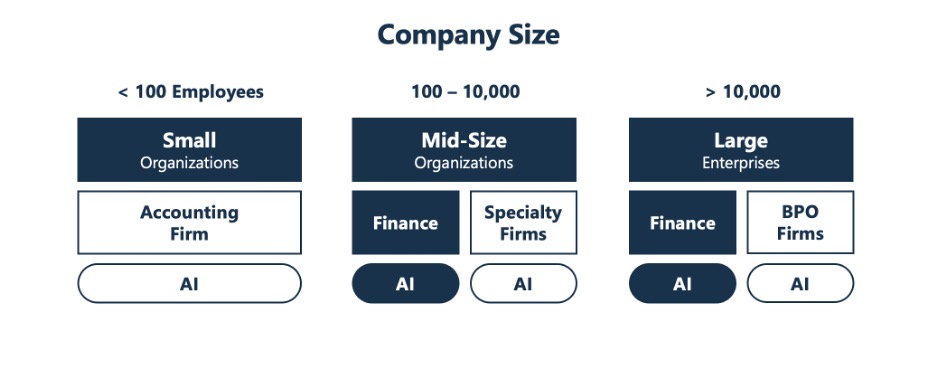

An AI implementation strategy should align with an organization's size and technical sophistication. The primary decision is whether to build an internal AI operations capability or leverage external providers.

Small Organizations: Organizations without dedicated finance teams should prioritize finding AI-first accounting firms. Due diligence should evaluate technological sophistication rather than pure competency, ensuring the provider delivers automation-driven cost reductions and analytical insights traditionally reserved for larger enterprises.

Mid-Size Companies: These organizations maintain internal finance teams for critical functions while leveraging specialty firms for complementary expertise. The recommended approach is to select a comprehensive AI software product for finance process automation while enabling internal teams to build custom solutions using no-code platforms. Mid-size organizations typically lack the scale to justify custom AI development but have sufficient complexity to benefit from integrated solutions beyond point tools.

Large Enterprises: Global organizations require a top-down culture that positions AI as a means of professional empowerment, supported by deliberate change management. These enterprises should evaluate AI-first business process outsourcing (BPO) providers for standardized processes, while building custom implementations to differentiate. Internal teams can leverage no-code platforms for departmental automations, while enterprise architecture teams establish governance frameworks and integration standards.

Accounting Firms: AI adoption is reshaping the business model of finance and accounting service providers. Firms that embrace automation are transitioning from labor-based billing to outcome-based pricing, offering defined deliverables at fixed fees rather than charging by the hour for manual work.

This transformation is visible across the small-firm landscape, where practitioners are deploying "agentic" workflows to bypass the traditional constraints of headcount. For a monthly software overhead of approximately $100 to $500, a solo firm in 2026 can now deploy platforms like Digits AGL or Docyt AI to act as "Digital Associates." These agents perform 24/7 autonomous reconciliation with 99 percent accuracy, compared to the 10 percent-15 percent error rate typical of manual entry.

The economic feasibility of this shift is significant: by automating 60 percent–70 percent of repetitive data ingestion, a solo practitioner can increase their capacity by roughly 55 percent without adding staff. This allows the firm to move from a $150/hour rate to a "Virtual CFO" package priced at a flat $2,500 monthly premium. At this scale, 2026 benchmarks show that AI-mature small firms are achieving a revenue-per-employee target of $250,000 to $400,000, effectively capturing the "efficiency surplus" as pure profit rather than passing it to the client as reduced billable hours.

This shift creates structural advantages. AI-first firms can serve more clients with fewer staff, deliver faster turnaround on recurring work, and redirect senior talent toward advisory services that command premium fees. Firms that delay AI adoption risk losing clients to providers offering equivalent services at lower cost with faster delivery.

Keeping Data Secure and Under Control

Because finance handles sensitive data, security forms the non-negotiable foundation of any AI strategy.

Data Sovereignty: Ensure proprietary information is never used to train public AI models. Evaluate vendor data handling policies and contractual protections.

Secure Environments: Deploy AI within private cloud environments that maintain SOC 2 Type II and ISO 42001 compliance. Verify certification status and audit reports.

Auditability: Maintain human-in-the-loop validation processes to ensure every AI-generated transaction or report is accompanied by documented accountability. Preserve decision trails for regulatory review.

A Phased Plan to Getting There

Success in AI adoption depends more on execution strategy than technology selection. A phased approach reduces risk while building organizational capability:

Phase | Key Activities

Alignment | Develop AI literacy and motivational alignment across the team before any technology deployment. Document existing processes. Establish security and governance requirements.

Quick Wins | Deploy AI in high-impact, low-risk areas such as invoice processing or bank reconciliation. Build internal momentum through visible successes. Measure and communicate productivity gains.

Expansion | Extend automation to additional processes based on accumulated learnings. Implement more sophisticated agent capabilities. Develop internal expertise for ongoing optimization.

Transformation | Move toward autonomous operations with human oversight for exceptions. Integrate AI insights into strategic decision-making. Continuously evaluate emerging AI capabilities.

Throughout implementation, avoid solutions that lack flexibility to evolve with rapid AI advancement. Every step should move the organization toward a model in which technology handles volume and professionals handle judgment.

Where This Is Heading

We're seeing a fundamental shift in how finance operates: AI is becoming the primary engine for processing financial information, while legacy systems are shifting to a supporting role as record-keepers. In this emerging model, AI agents—increasingly characterized in literature as "Digital Seniors"—execute multi-step cognitive workflows that were once the exclusive domain of junior professional staff.

This doesn't mean finance professionals are becoming obsolete. Their role is shifting toward serving as a "human-in-the-loop" supervisor, guiding AI systems and ensuring algorithmic integrity, upholding ethical standards and providing strategic judgment that remains beyond the current capabilities of AI applications. Data from 2026 confirms the viability of this model: firms that have successfully integrated these systems have recorded a 23 percent increase in revenue per employee, driven by the automation of approximately 74 percent of billable manual tasks.

Crucially, the accessibility of these "agentic" solutions has lowered the barrier to entry, allowing small and solo firms to compete with larger enterprises on the basis of analytical velocity rather than headcount. The primary obstacle to adoption is no longer technical or financial, but cultural. Organizations need to move past their fear of risk and embrace a more experimental mindset, one that is willing to try new approaches. When firms treat AI as collaborative infrastructure rather than just another tool, they can break the link between growth and headcount, empowering their people to focus on the strategic challenges that require human judgment.

Svetlana Gadzhieva, CPA is a member of the CalCPA Accounting Principles and Assurance Services Committee.

Andy Zhulenev is owner of AI Transformation Consulting.